Covid-19: Early indications suggest property market recovery is likely

Initial predictions regarding the future of the residential property market as a result of the Covid-19 lockdown painted a sombre picture: significant drops in house prices, more supply than demand, and people unable to afford their home loans.

However, it was not possible to put these predictions to the test until recently. With Level 3 of South Africa's lockdown regulations now in place, the property industry has been able to return to work.

What this means is that the first deals in a long time can be concluded. People who have viewed a property online can now view it in person and, if they are keen on it, submit an offer to purchase. From mid-March to end-May, the period when the industry was essentially shut down, home loan applications continued to be submitted. Most were, however, subject to one important condition: that the offer to purchase could only be confirmed once the potential buyer had viewed the house and decided to go ahead. Thankfully, this process can now take place.

With the first week of the property market having opened up again, indications are that some of the most dire predictions may not be coming true. BetterBond statistics show that there continues to be interest in buying residential properties among South African consumers and, most significantly, that the banks are keen to lend to prospective buyers who are in good standing financially.

Bond approval rate

There was concern about banks' lending requirements becoming more stringent and home loan applications being turned down due to greater risk posed by an uncertain employment environment. But the latest figures are encouraging in terms of the banks' willingness to lend to buyers who have been through the pre-approval process that BetterBond conducts. In fact, in May, the bank approval rate for bond applications was at 76% - which is only a slight drop from previous months.

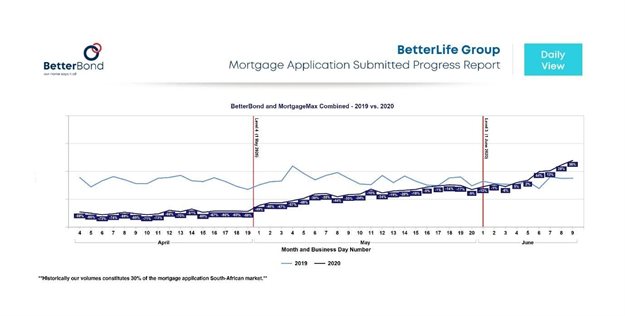

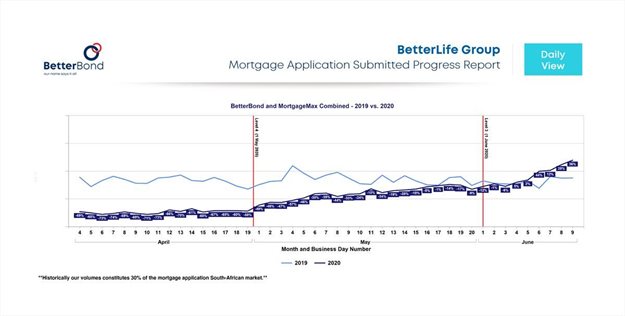

In addition, there are signs of recovery in terms of home loan application numbers. In April, we saw a 70% drop year-on-year, but in May, this improved to only 30% lower year-on-year. And thus far in June, we have numbers in excess of pre-pandemic targets (see below chart). This could be either pent-up demand, or low interest rates driving demand. If this trend continues during the remainder of June, we could be looking at a substantial recovery in the residential property market sooner than expected, at least with regards to activity and the granting of home loans by the banks.

|

Positive activity from first-time homebuyers

BetterBond has also seen positive activity from first-time homebuyers, with 70% of applications received in May coming from this category of buyers. The approval of bonds for first-time buyers is at its highest for three years, suggesting that a good number of these applications are realistic in terms of affordability, which bodes well for their bond repayments over time.

First-time buyer numbers reflect the market's understanding that the current scenario is the most favourable it's been in many years for people who want to get into home-ownership. Many of them couldn't afford it until now, but with interest rates at 50-year lows, it's the best opportunity new buyers have had for decades to acquire property.

As for predictions regarding downward trends in property prices, this cannot be accurately assessed yet. More property transfers would need to go through the Deeds Office before figures will become available that will allow us to compare prices pre-, during and post-lockdown.

|

BetterBond believes that properties under the R2.5m mark will hold up strongly and could even experience price growth, but at the higher end we are likely to see property prices under downward pressure.

Significantly, activity has not slowed to the extent that many had expected and is, in fact, picking up. This shows that the pandemic has brought about the expected slowdown in the property market, but that a potentially healthy recovery is on the go.

Author SA Property Insider